Copper is the metal most tied to the global economy because of its essential role in sectors from transportation to manufacturing and electrification. A growing emphasis on clean energy means global demand for copper can only grow.

BHP, the world’s biggest mining company, projects copper demand to explode and rise by 70% in 2050, reaching 50 million tonnes per year.

To meet this staggering demand, the mining industry would need hundreds of billions in investment to keep pace and grow enough supply. BloombergNEF estimates that as much as $2.1 trillion could be required by 2050 to meet the raw materials demand of a net-zero world.

This places tremendous pressure on mining companies to not just discover new sources of supply, but also expand on their existing operations to achieve supply growth.

Over the next few years and decades, the biggest copper mines would play a pivotal role in the energy transition.

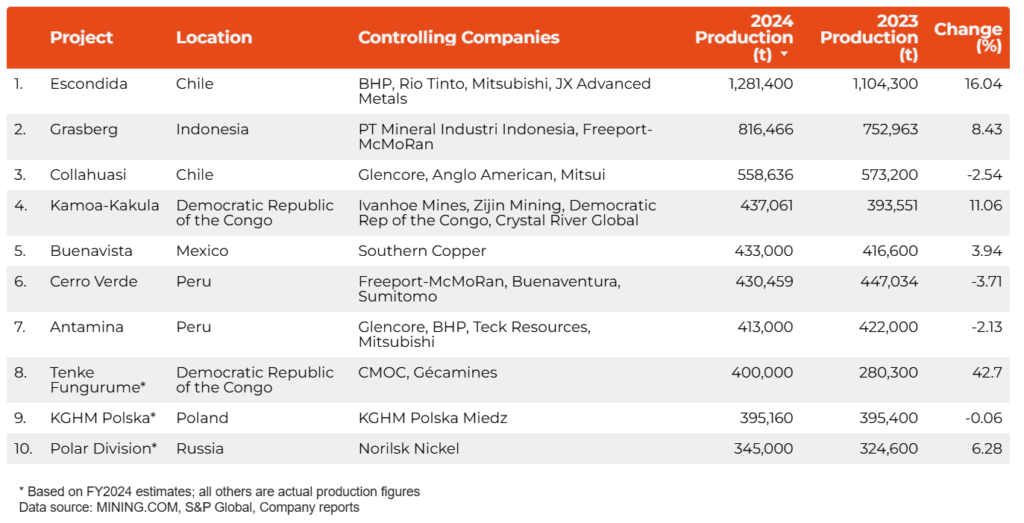

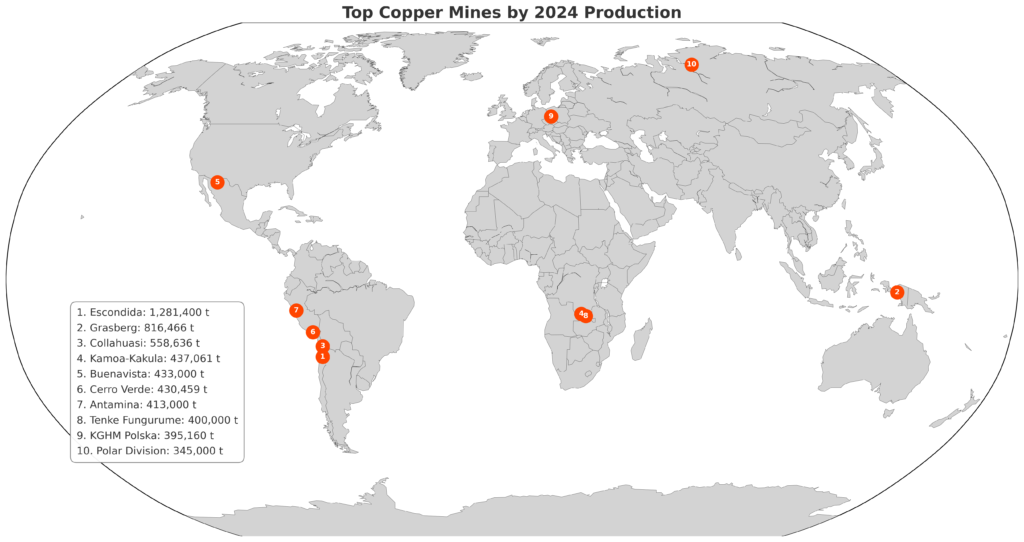

Below is a list of the worlds 10 biggest by 2024 production:

# 1: Escondida

The vast Escondida mine in Chile retains its top spot, churning out 1.28 million tonnes of metal for an increase of 16% from 2023. Escondida is majority owned and managed by BHP (57.5%), with Rio Tinto holding 30% and Japan’s Mitsubishi and JX Advanced Metals the remaining 12.5%.

In February, BHP said it would move forward with a $2 billion plan to optimize its concentrator at Escondida, the first initiative of its decade-long $10.8 billion investment plan announced last year.

BHP’s copper production in 2025’s first three months climbed 10%, boosted by the ramp-up of Escondida operations.

#2: Grasberg

Jointly owned by Freeport McMoRan and PT Mineral Industri Indonesia, the Grasberg mine produced 816,466 tonnes of copper in 2024, up 8.4% from 2023. Work at Grasberg was halted temporarily in 2023 after flooding and debris flow from heavy rains and landslides damaged its milling complex, but the skies were fairer in 2024.

#3: Collahuasi

The Collahuasi mine in Chile, jointly owned by Glencore, Anglo American and Mitsui, saw its production fall 2.5% to 558,636 tonnes in 2024, compared to 573,200 tonnes from the prior year. Watch a compilation of 21 years of mining at Collahuasi in 21 seconds here.

#4: Kamoa- Kakula

The Kamoa-Kakula mine complex, jointly owned by Ivanhoe Mines, Zining Mining, the DRC government and Crystal River Global, increased its production to 437,061 tonnes in 2024, up 11% from 2023. Kamoa-Kakula in 2023 was named the world’s lowest carbon-emitting major copper mine.

#5: Buenavista

The Buenavista mine in Mexico came in fifth place with 433,000 tonnes of metal produced in 2024, up nearly 4% from the 416,600 tonnes in 2023. Wholly owned by Grupo Mexico subsidiary Southern Copper, Buenavista has been producing since 1899, making it the oldest operating copper mine in North America.

#6: Cerro Verde

In sixth place is Cerro Verde in Peru, an open-pit copper and molybdenum mining complex that is a joint venture between Freeport McMoRan, Buenaventura and Sumitomo. In 2024, Cerro Verde produced 430,459 tonnes, down 3.71% from 447,034 tonnes in 2023.

#7: Antamina

Also in Peru, Antamina is jointly owned by Glencore, BHP, Teck Resources and Mitsubishi. The mine produced 413,000 tonnes in 2024, a 2.13% decline from 422,000 tonnes in 2023.

Production figures for the mines below are based on FY2024 estimates:

#8: Tenke Fungurume

The second Congolese mine on the list, Tenke Fungurume produced an estimated 400,000 tonnes in 2024, which would represent a 42.7% yearly jump. In 2021, China’s CMOC, which jointly owns the mine with Congo state-controlled Gécamines, invested $2.51 billion to double its production. The project was completed and came online in 2023.

#9: KGHM Polska Miedz

The only mine in Europe to make the list is KGHM Polska’s Miedz in Poland, churning out an estimated 395,160 tonnes in 2024, approximately in line with the 395,400 tonnes from 2023.

#10: Polar Division

The Polar Division copper mine in Russia, owned by Norilsk Nickel, rounds out the list with an estimated 345,000 tonnes in 2024, an approximate increase 6.3% from the 324,600 tonnes in 2023.

*Cobre Panama, Central America’s largest open-pit copper mine, produced 330,863 tonnes of copper in 2023 before the government ordered it to shut down. If it was still operating, it would have become a 100-million-tonne-a-year operation in 2024, placing it near the top of the world’s copper throughput ranking.