In 2024, the African hotel development landscape is succinctly summarized by the phrase “Egypt and the Big 5,” referring not to wildlife but to global hotel chains like Accor, Hilton, IHG, Marriott International, and Radisson Hotel Group. The latest African Hotel Chain Development Pipeline report, a reputable industry source, reveals Egypt’s commanding 28% market share alongside the Big 5’s dominant 71% share.

Conducted by the Lagos-based W Hospitality Group in collaboration with the Africa Hospitality Investment Forum (AHIF), the survey gathered insights from 47 global and regional hotel chains, detailing plans for 92,000 rooms across 524 hotels in 41 African countries.

Key trends from the past year include notable growth of over 9% in both North and sub-Saharan Africa, a rise in the size of large hotels (with the top 10 averaging 770 rooms, up from 723 in 2023), and a rapid increase in resorts, up by 32% compared to 2023. Notably, Zanzibar has experienced significant growth, with its resort pipeline nearly doubling from 983 rooms in 2023 to 2,048 rooms in 2024, signaling confidence in the allure of these idyllic Indian Ocean islands.

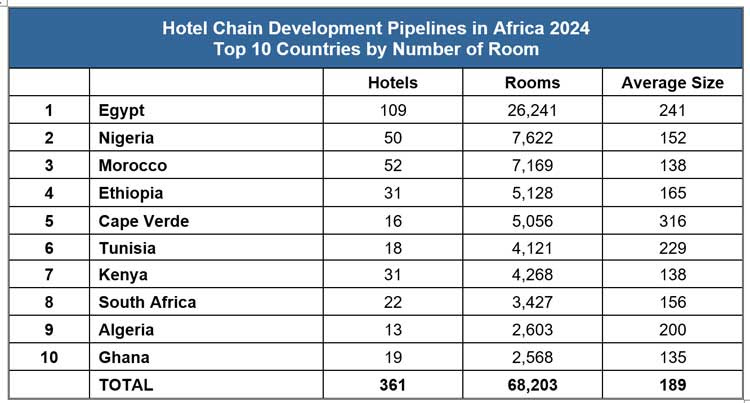

Egypt’s dominance in the African hotel development scene remains striking, boasting a pipeline of almost 26,250 rooms across 109 hotels—a remarkable feat compared to other countries. Egypt’s pipeline dwarfs that of Nigeria, Morocco, and Ethiopia combined, with Nigeria coming in second with 7,622 rooms across 50 hotels, followed by Morocco with 7,169 rooms in 52 hotels, and Ethiopia with 5,128 rooms spread across 31 properties.

The resort sector has seen a remarkable surge in pipeline projects, escalating from 24% of the total in 2023 to 30% in 2024. Moreover, approximately half of the rooms introduced in newly opened hotels and resorts last year were located within resorts. Notably, Boa Vista in Cape Verde and Sharm El Sheikh in Egypt stand out due to the exceptionally large average size of their resorts. The pinnacle of this trend is exemplified by a forthcoming Rixos resort in Sharm El Sheikh, set to become the largest hotel in the entire pipeline, boasting over 1,800 rooms.

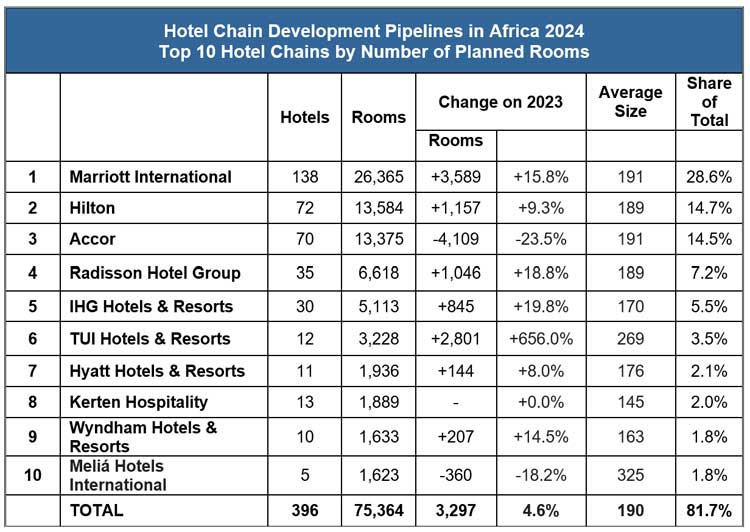

The dominant Big 5 global chains—Marriott International, Hilton, Accor, Radisson Hotel Group, and IHG Hotels & Resorts—command a substantial share of the African pipeline, encompassing 66% of hotels and 71% of rooms.

Marriott International, the globe’s largest hotel chain, maintains its formidable lead for the third consecutive year. It holds a seemingly unassailable position at the top, boasting nearly double the number of pipeline hotels and rooms compared to Hilton, the second-place contender. Additionally, Marriott International has added the largest number of rooms within the year.

Reflecting on past years, there was once a close competition between Accor and Marriott International. However, for the second consecutive year, Accor’s pipeline has seen a decline, dropping from a peak of approximately 20,250 rooms in 2022 to 13,375 rooms presently. Executives explain that their focus lies on maintaining a “clean and achievable pipeline” rather than merely chasing numbers.

Accor’s statement underscores a significant challenge in monitoring hotel development in Africa, which involves distinguishing between proposed, under-construction, and completed projects. Typically, the duration from signing to opening spans between four to five years. Nonetheless, the report identifies 35 projects in the pipeline that have exceeded the ten-year mark, including one hotel signed a staggering 16 years ago.

In terms of hotels currently under construction, Marriott International leads the pack with 138 hotels (totaling 15,011 rooms). Following closely behind are Hilton (72 hotels, 5,955 rooms), Radisson Hotel Group (35 hotels, 5,748 rooms), and Accor (70 hotels, 3,346 rooms). Notably, TUI Hotels & Resorts has surged into the rankings, securing fifth place with 12 hotels (2,208 rooms) under construction.

In addition to analyzing potential deals, which may or may not come to fruition, W Hospitality Group also delved into hotel openings across Africa in 2023 and their locations. Out of the total 29 chain hotels and resorts that debuted in Africa that year, 10 were situated in North Africa, while 19 were in sub-Saharan Africa. Within the 19 openings in sub-Saharan Africa, 11 were located in East Africa, including six newly established hotels and resorts in Tanzania, which witnessed the highest number of openings among African countries. This surge underscores the allure of both the mainland and Zanzibar to investors and operators.

Accor emerged as the leader in hotel openings last year and also held the top spot for the number of hotels and rooms launched over the past five years (2019-2023), with 34 hotels opening, totaling approximately 5,500 rooms.

Regarding “actualization,” 2023 witnessed a notably sluggish pace. However, this is anticipated to be counterbalanced by a robust 2024, during which the top 10 chains anticipate opening 139 hotels comprising 19,122 rooms.

Trevor Ward, Managing Director, W Hospitality Group, said: Our report contains very positive data, with the pipeline expanding by more than 9 per cent in 2023. This is the largest increase since 2018 and, according to data produced by CoStar/STR, is one of the highest increases globally, surpassed only by the Americas. We look not just at signed deals and their status, but also at the historical actualisation of these deals. This year, we’ve placed greater emphasis than we have in the past on the actualisation, because if the deals don’t become operating businesses, generating profits for the owners and paying fees to the hotel chains, no one’s objectives are being met, are they?

“We’re looking forward to some 139 hotels and resorts opening in Africa in 2024, with expectations of a far greater actualisation rate than in recent years, as Africa strives to achieve its fair share of the global hotel industry”.

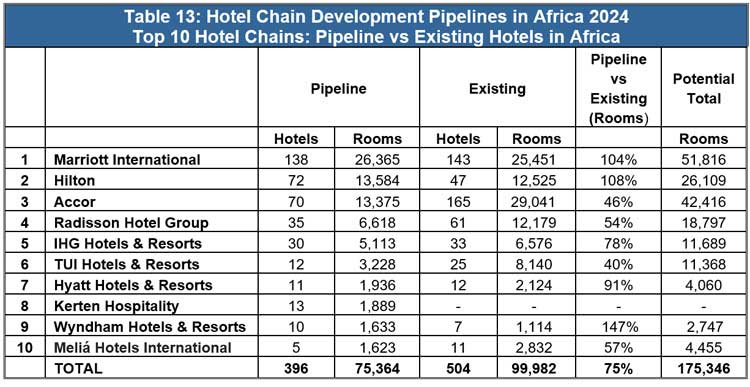

Considering both existing hotels and those in the development pipeline, Accor emerges as the continent’s dominant player with 165 hotels totaling 29,041 rooms in operation. Marriott International follows closely in second place with 25,451 rooms across 143 hotels. Hilton secures third position with 12,525 rooms distributed among 47 hotels, and Radisson Hotel Group closely trails with 12,179 rooms in 61 properties. However, if Marriott International successfully delivers all the rooms in its pipeline, it is poised to surpass Accor and assume the lead position with 51,816 rooms in operation.

Matthew Weihs, Managing Director of The Bench, which organises the Africa Hospitality Investment Forum (AHIF), concluded: “The report reveals some very positive trends, including strong growth in new hotel projects, the emergence of high-quality white label hotel operators and governments successfully attracting investment into their tourism industries. All this bodes well for deal-making discussions at AHIF.”

Trevor Ward will deliver an update on the pipeline development survey, offering comprehensive insights, during AHIF at the Mövenpick Hotel, Windhoek, Namibia, from June 25th to 27th, 2024.

AHIF stands as the foremost gathering of hospitality executives in Africa, fostering connections among business leaders and driving investment in tourism projects, infrastructure, and hotel development across the continent.