China strengthens its grip on global lithium trade amid processing plant building boom in Zimbabwe

- A flurry of building work by Chinese mining companies in Africa has seen several lithium processing plants begin operation

- The plants saw lithium exports from Zimbabwe double last year, and this year capacity is predicted to triple on last year’s figures

Major Chinese companies, including Zhejiang Huayou Cobalt, Sinomine Resource Group and Chengxin Lithium Group, all completed the construction or upgrade of lithium processing plants in Zimbabwe last year.

According to data from London-based price reporting agency Benchmark Mineral Intelligence, in the three months to the end of November 2023 Zimbabwean spodumene concentrate exports to China increased nearly five-fold to 177,000 tonnes (195,109 tons), compared to 38,000 tonnes in the same period of 2022.

But that was not a gradual rise. After the Chinese companies commissioned lithium processing plants in May 2023, exports began to increase, jumping from 16,000 tonnes in June to 36,000 tonnes in August. They then more than doubled to 84,000 in November.

Adam Megginson, a price and data analyst at Benchmark Mineral Intelligence, said 2024 is set to be an even bigger year, with several major projects due to come online which will see Zimbabwe’s lithium capacity triple compared to 2023.

At present, Megginson said, the facilities in Zimbabwe are producing spodumene or petalite concentrate which, while not completely raw products, still require further refining. This process, also referred to as beneficiation, then turns the concentrate into chemicals that can be used in the production of lithium-ion batteries.

“For these projects, this further processing is currently happening entirely in China, though there is strong political momentum – not only in Zimbabwe – towards encouraging more of this refining capacity to take place in the country of extraction,” Megginson said. “This is to capture more of the added value of this step in the process domestically.”

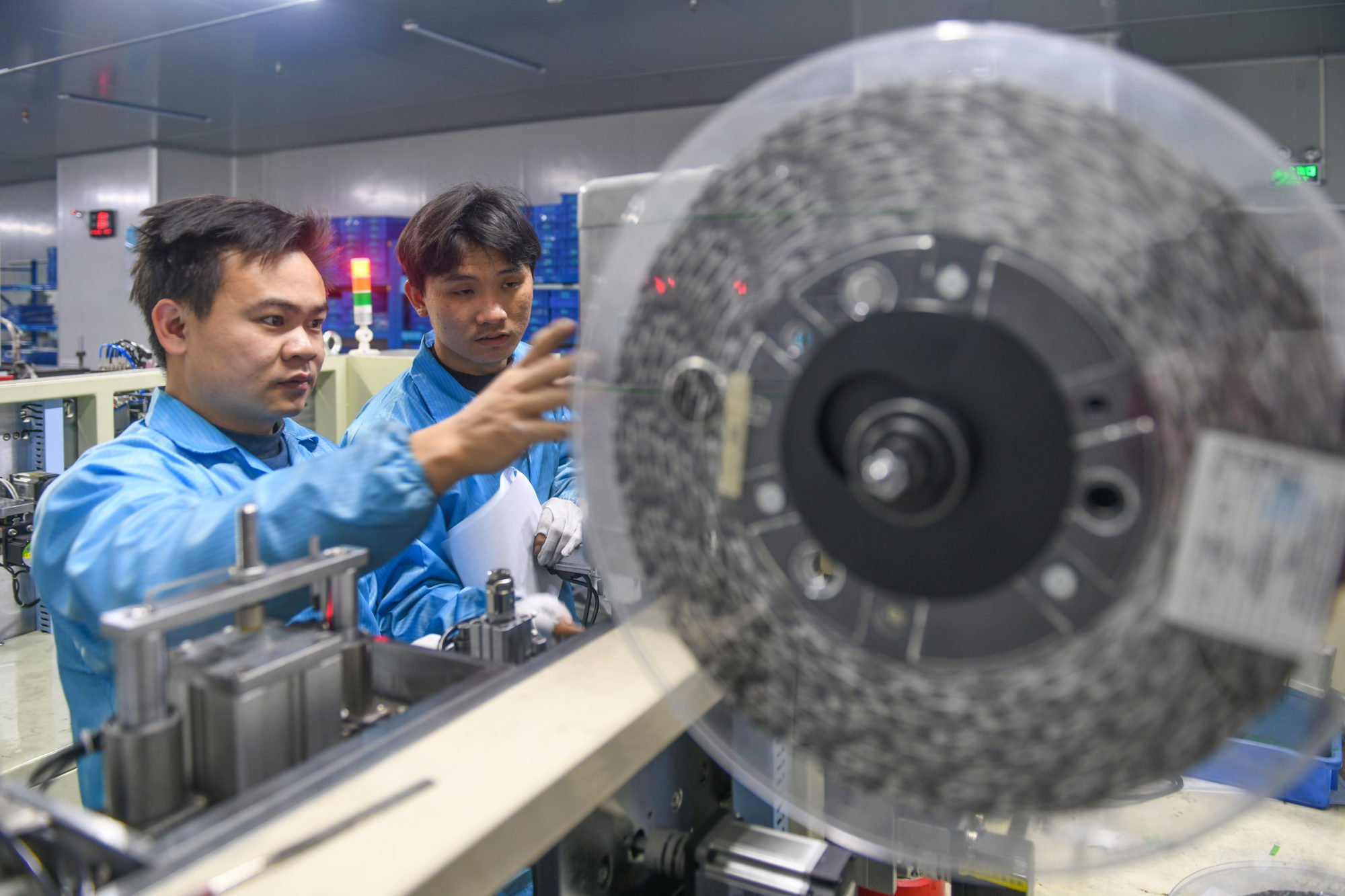

Most of the Chinese lithium producers operating in Africa, though, would rather continue to refine material in China, because doing so keeps their costs low, he said. Aside from the expense of constructing or improving refining capabilities in a different country, it is also harder to staff these projects with knowledgeable workers, while those people are readily available in China.

He said although Zimbabwe’s lithium raw materials capacity is growing rapidly, with Benchmark forecasting 196 per cent growth from 2023 to 2024, the country’s overall impact on the global lithium market is limited.

Megginson said Benchmark estimates the total size of the lithium raw materials market will be nearly 1.2 million tonnes of lithium carbonate equivalent (LCE) in 2024, and Zimbabwe will account for 6 per cent of this.

“While companies in other countries are also considering developing assets in Africa, China is currently a front runner on these developments,” Megginson said.

Benchmark forecasts that by the end of the decade, Africa will contribute a 14 per cent share of global lithium raw materials supply, up from a 4 per cent share last year.

Then in November 2023, China’s Sinomine Resource Group commissioned the Bikita Minerals spodumene and petalite processing plants in the Masvingo province in southeast Zimbabwe. The spodumene plant is expected to produce 20,000 tonnes per month, while the petalite plant will produce 30,000 tonnes per month, compared to an annual output of 50,000 tonnes before the upgrade.

The Chinese mining company spent US$300 million on construction of the plants. In June 2022, Sinomine Resource Group paid US$180 million to buy the Bikita mine, which holds the world’s largest-known deposit of lithium at around 11 million tonnes. At the time of the sale, the mine, which started its lithium operations in the 1950s, was Zimbabwe’s only producing lithium mine.

It has a processing capacity of 4.5 million tonnes of hard rock lithium, which translates to around 400,000 tonnes of concentrate per year for export. Huayou Cobalt acquired the Arcadia mine in 2021 for US$422 million from Australian company Prospect Resources.

Also, in May last year, another Chinese company, Chengxin Lithium Group, commissioned a 300,000 tonne per year lithium concentrator at the Sabi Star mine in eastern Zimbabwe.

In 2021, the company spent US$77 million on a deal that included mining rights in the largely unexplored Sabi Star mine. It spent US$130 million building its lithium processing plant.

Chris Berry, president of commodities advisory firm House Mountain Partners in New York, said Africa will have to become a major source of lithium supply in the future to restore long-term balance to the lithium market.

“I would think that the lithium mined and refined across Africa is destined to end up in China, given the substantial presence of Chinese lithium companies in some of the countries mentioned,” Berry said.

He added there is likely to be a significant ramp up of lithium production in Zimbabwe and, in the near-term, in the West African nation of Mali.

“This is likely to strengthen China’s hand in dominating the lithium supply chain, especially if the material is refined by Chinese companies,” Berry said.

China also has interests in the DRC’s Manono lithium project, and in Namibia where the EU is vying to export rare earth materials to Europe.