The African Export-Import Bank (Afreximbank) and the United Nations Economic Commission for Africa (ECA) have signed a framework agreement with the Democratic Republic of Congo and Zambia for the establishment of special economic zones for the production of electric vehicles and batteries as the continent looks to add value to surging demand for its critical minerals.

Both countries have major reserves of some of the critical minerals needed to produce batteries for electric vehicles and other technologies key to the green energy transition: the DRC accounts for approximately 70% of global cobalt supply and 88% of cobalt exports, and the two countries collectively contribute 11% of all copper supply globally. Both countries also possess reserves of lithium, a key ingredient in electric vehicle batteries. But until now both nations been relegated to the role of suppliers of unprocessed critical minerals to foreign manufacturers.

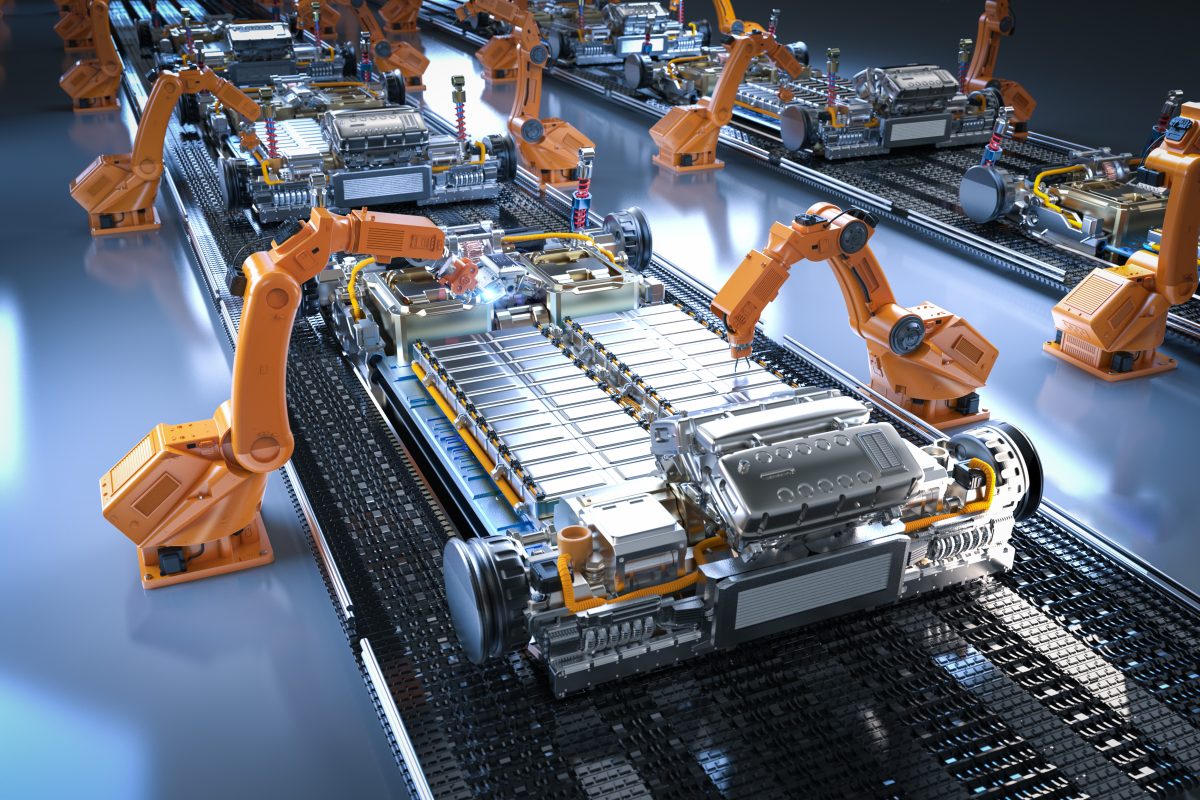

In order to ensure that the countries move higher up in the value chain, Afreximbank and ECA will lead the establishment of an operating company in consortium with public and private investors and Afreximbank’s impact fund subsidiary, the Fund for Export Development in Africa. The new company will develop special economic zones (SEZs) dedicated to the production of battery precursors, batteries, and electric vehicles, in both nations.

SEZs come in many forms, and their effectiveness in Africa is the topic of much debate, but they are usually geographically limited areas where companies enjoy tax benefits and other legal privileges, set up in order to attract foreign investment and boost employment.

ARISE Integrate Industrial Platform, a pan-African infrastructure developer, has been selected as the technical consultant to conduct the pre-feasibility study for the establishment of the SEZs in DRC and Zambia.

The organisers say the project “will deploy well-established and proven EV technology that will enable both countries to exploit their mineral resources at scale. It will accelerate the manufacture of pre-export value added products, enabling them to capture more value within these states and it will result in new demand for skilled engineers with technical expertise, providing a significant boost to local labour markets.”

Manufacturing challenges

But as African Business reported in January, there are significant barriers to the establishment of battery manufacturing facilities in Africa. No single African country has all the minerals required to produce batteries, meaning that countries will need to pool mineral supplies to achieve the minimum scale and reliability, according to the Natural Resource Governance Institute’s (NRGI) Triple Win report, as well as making sure that they are not committing too large a share of their minerals for export.

Affordability and a lack of grid-scale charging infrastructure mean that the Africa-wide market for four-wheeled electric vehicles is expected to be small for decades: the value chain for batteries made from nickel, manganese and cobalt (NMC) may thus be confined to producing battery precursor material.

But with larger potential in the African market for two-and-three wheel electric vehicles, which use lithium, iron and phosphate (LFP) batteries – industries based on battery chemistry could be viable, NRGI suggests. That will require investment in cell manufacturing plants, which could be eased along by support for domestic two and three-wheeled EV manufacturers, more lithium discoveries and regional coordination on lithium refining.

Institutional problems also abound. In a survey of four critical mineral-rich African countries – the DRC (cobalt), Mozambique (graphite), Madagascar (graphite and nickel), and Guinea (bauxite) – the Peterson Institute found that none of the four countries has the energy infrastructure needed to expand capacity for refining – in which raw critical minerals are processed into the ingredients for green energy technologies.

Still, the institutions are confident that the establishment of SEZs in the DRC and Zambia will help the countries to move up the mineral value chain. Antonio Pedro, interim executive secretary of ECA, hailed the agreement as “an important step in ensuring we have the right enabling policies in place for the region to benefit from the so-called green mineral boom”.

Oluranti Doherty, Afreximbank’s director of export development, said: “The execution of this framework agreement testifies to a strong commitment by the governments of the DRC and Zambia, Afreximbank and ECA, as well as other partners, to promote inclusive development of the Battery Electric Vehicle value chain, also rendering the DRC and Zambia globally competitive investment destinations.

At Afreximbank, we are firmly convinced that Industrial Parks and Special Economic Zones are critical tools the continent can deploy to fast-track its industrial infrastructure development, promote Intra-African Trade, accelerate the implementation of the AfCFTA and facilitate Export Development.”

‘Governments need to step up’

In a recent interview with African Business, Ngozi Okonjo-Iweala, director-general of the World Trade Organization, stressed the need for African countries to make themselves part of the supply chain for EVs and insist on agreements to process those minerals on the continent in order to add value and create jobs.

“This is a time for us to make sure we are part of the supply chains for these new products. And we’ve got the minerals that are actually looked for, many of them are on the continent. I think Africans really need to this time, in a concerted fashion, make a case for the part of this supply chain for electric-powered vehicles that everybody is trying to manufacture.

“Our governments need to step up so we can take advantage because I’ve seen investment moving elsewhere,” she commented.